Build

Build your strengths as a strategic finance leader. Enhance your technical skills, financial expertise and leadership abilities, elevating your credibility as a trusted advisor and key decision-maker.

Elevate your impact as a finance leader

Download Brochure

28 June 2024

7 Months

Online and In Person

The Chief Financial Officer (CFO) Programme is a transformative learning journey designed to broaden your perspective and prepare you for the role of a strategic CFO. Enhance your skills to better align financial and corporate strategy, while learning to leverage AI and analytics to improve financial decision-making. The programme will further hone your ability to effectively communicate financial acumen and collaborate across functions.

CFOs see their role fundamentally changing as finance tasks are automated.

CFOs say that combining state-of-the-art technology with process improvement will be a major focus for the future of the finance function.

London – A global hub

Connect with global peers and experience learning in the heart of London.

World-leading faculty

Learn from LBS's world-renowned experts in finance, leadership and strategy.

Individual business project

Apply your programme learnings to a transformative individual project.

Diverse peer network

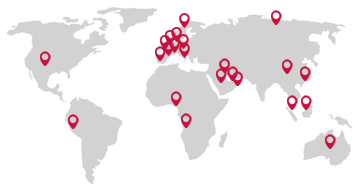

Discuss, debate and explore key business and financial issues with a diverse and global peer network.

Strategic challenge

Develop an action plan for a business challenge you are currently facing and tackle it on your return to work.

Comprehensive curriculum

Benefit from a future-focused curriculum that seamlessly integrates finance, leadership and strategy.

Rewire learning

Work on a challenge developed to help you dive deep into specific areas of the transformation agenda.

Expert guest speakers

Gain new perspectives, ideas and insights from finance experts.

Real-world case studies

Explore real case studies, surveys and academic evidence from leading global companies.

Alumni network

Join our 17,000-strong LBS Executive Education alumni network and build your connections.

The CFO Programme is designed to help you develop your leadership, strategy and communication capabilities to drive innovation and technological transformation throughout your organisation.

Build your strengths as a strategic finance leader. Enhance your technical skills, financial expertise and leadership abilities, elevating your credibility as a trusted advisor and key decision-maker.

Engage with world-class faculty and industry practitioners with live online learning and in-person sessions in the heart of London. Get expert insights into the latest thinking on finance strategy, leadership and innovation.

Make a transformative impact on your organisation. Identify, evaluate, communicate and drive the implementation of strategic choices that lead to sustainable value creation and growth.

The CFO Programme is ideal for:

Background and experience:

Upon successful completion of the programme, participants will be awarded a verified digital certificate of achievement by London Business School.

This seven-month programme journey features two on-campus immersion modules of one week each and two multi-week virtual modules. The curriculum explores various themes that are crucial for a modern CFO. You will learn through virtual and in-person classes, guest lectures, group coaching sessions, live case studies and academic director check-ins.

Access to learning platform | VirtualNote: Programme schedule is subject to change.

This certificate programme does not grant academic credit or a degree from London Business School.

Emeritus collects all programme payments, provides learner enrolment and programme support, and manages learning platform services.

For the programme refund and deferral policy, please click the link here.

Flexible payment options available.